[ad_1]

The price of any asset is always impacted by a combination of factors. Unlike traditional financial assets, bitcoin has historically had its own set of factors affecting its price. Do things look any different now? Let’s find out.

Basic Factors: Supply And Demand

Bitcoin’s price is heavily dependent on supply and demand fluctuations, just like other assets. However, contrary to measures of fiat money, bitcoin’s supply is always known and its hard cap is set at 21 million coins.

The demand for bitcoin always sits at the top of the cryptocurrency world’s agenda — that’s why adoption of BTC is so talked about. Higher demand will lead to an increase in its price, especially when institutional investors get involved.

For example, when companies and institutions began buying and holding bitcoin in early 2021, its price rose significantly as demand outpaced the rate at which new coins were being placed on the market for sale, resulting in a decrease in the total available supply of the cryptocurrency.

Its price will drop, however, if there are more people who want to sell it.

Institutional Adoption

News influences investor perception about Bitcoin in a major way.

In spite of extreme volatility in bitcoin’s price, the year 2021 stands out for its unprecedented adoption by both institutions and corporations.

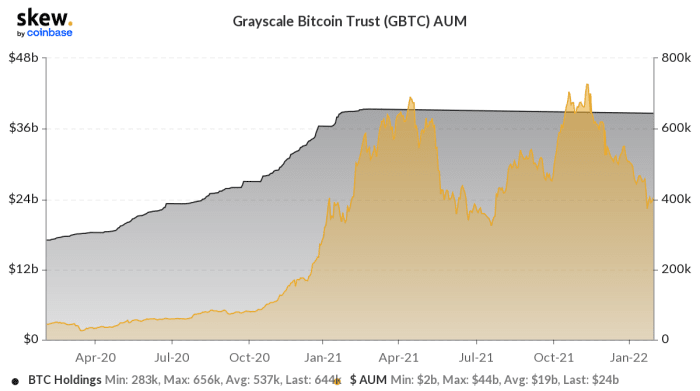

For example, Grayscale Bitcoin Trust had an average AUM of $31 billion and an average Bitcoin holding of 650K in 2021.

Crypto Regulation

Bitcoin’s price is also affected by regulatory developments. Changes in regulation can encourage or discourage investment in BTC or in its use, which in turn leads to an increase or decrease in its price.

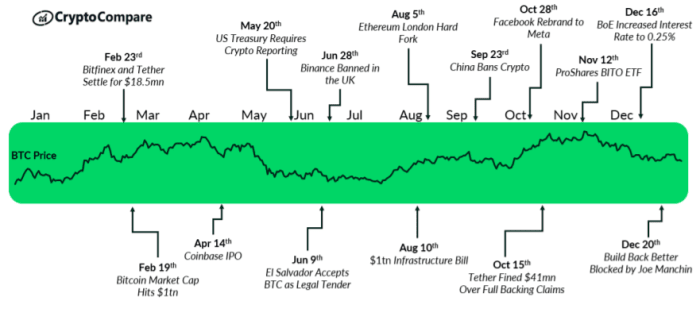

Here’s how the bitcoin price overlaid with regulatory events in 2021 looks:

Image source: 2022 CryptoCompare Outlook report

News Indirectly Related To Bitcoin

Let’s consider an example of how indirect news events, such as reports about a political situation in a country somewhere in the world, can substantially impact the price of BTC.

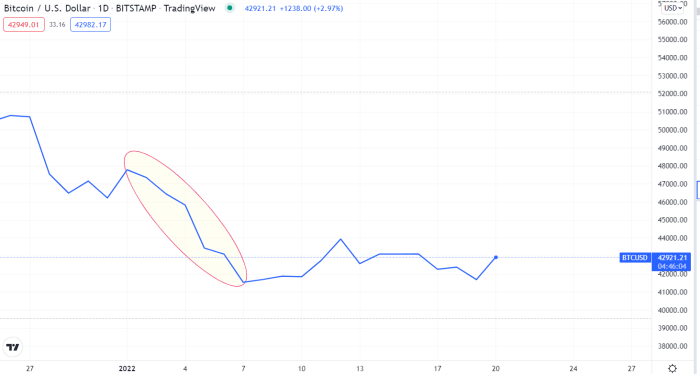

On 2 January, 2022, a week-long uprising started in Kazakhstan. Most people hadn’t realized the significance of this event for the crypto market. In recent years, Kazakhstan became the world’s number two bitcoin miner based on hash rate. It accounts for about 18% of the global hash rate, and is only outdone by the United States.

So, with the news of an uprising, it took about 24 hours for the crypto market to react, and the BTC price plunged a combined 13.1% from January 2 to January 8.

Image source: TradingView

BTC Increasingly Resembles Traditional Assets

In theory, traditional market-related news such as reports on the macroeconomic environment or monetary policy decisions of central banks should not affect cryptocurrencies owing to their decentralized nature. However, the current trend suggests otherwise.

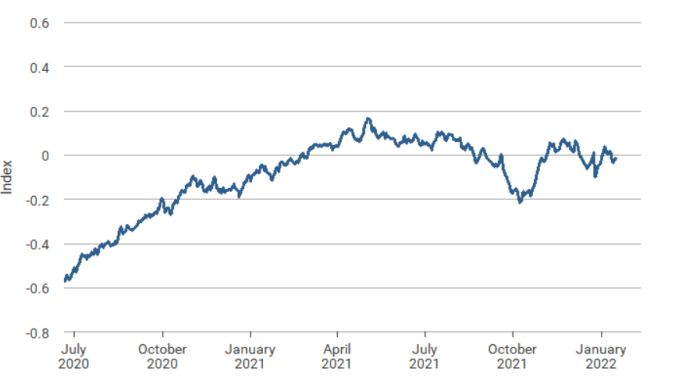

Global news sentiment has a big impact on equity returns around the world, according to World Bank research. This effect is not reversible in the short run, suggesting an underlying source of sentiment-driven asset price fluctuations.

Below is the Daily News Sentiment Index by the Federal Reserve Bank of San Francisco, which gives an overall measure of economic sentiment by analyzing news articles:

Image source: Federal Reserve Bank of San Francisco

Although Bitcoin is not a traditional asset, it appears that the general news sentiment influences its value.

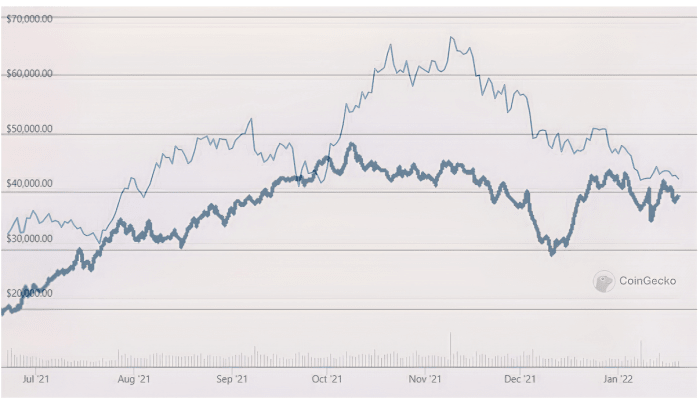

Here’s what bitcoin’s price chart looks like when combined with the news sentiment index for the same period:

Image source: Author, data from CoinGecko

Recent data on Bitcoin and major stock indices correlation also suggests this.

Historically, crypto assets didn’t show a strong correlation with major stock indices. In the latest Coinmetrics data, however, the daily correlation between bitcoin and the S&P 500 jumped to 0.47 on January 28, 2022, indicating a close correlation.

Image source: Coinmetrics.io

Bottom Line

As the crypto market matures, new trends are emerging that we haven’t observed before. Initially a fringe asset, bitcoin is now increasingly acting like a traditional asset, sensitive to the same market forces that affect those markets. In addition to news on crypto regulations and institutional adoption, bitcoin’s price is affected by changes in general economic conditions and world events that impact traditional markets.

This is a guest post by Mike Ermolaev. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Recent Comments