[ad_1]

- A $5 billion difference between XRP and USDC could make it difficult for the token to rise back to 6th.

- Though the exchange outflow was way more than the inflow, the price might see another red.

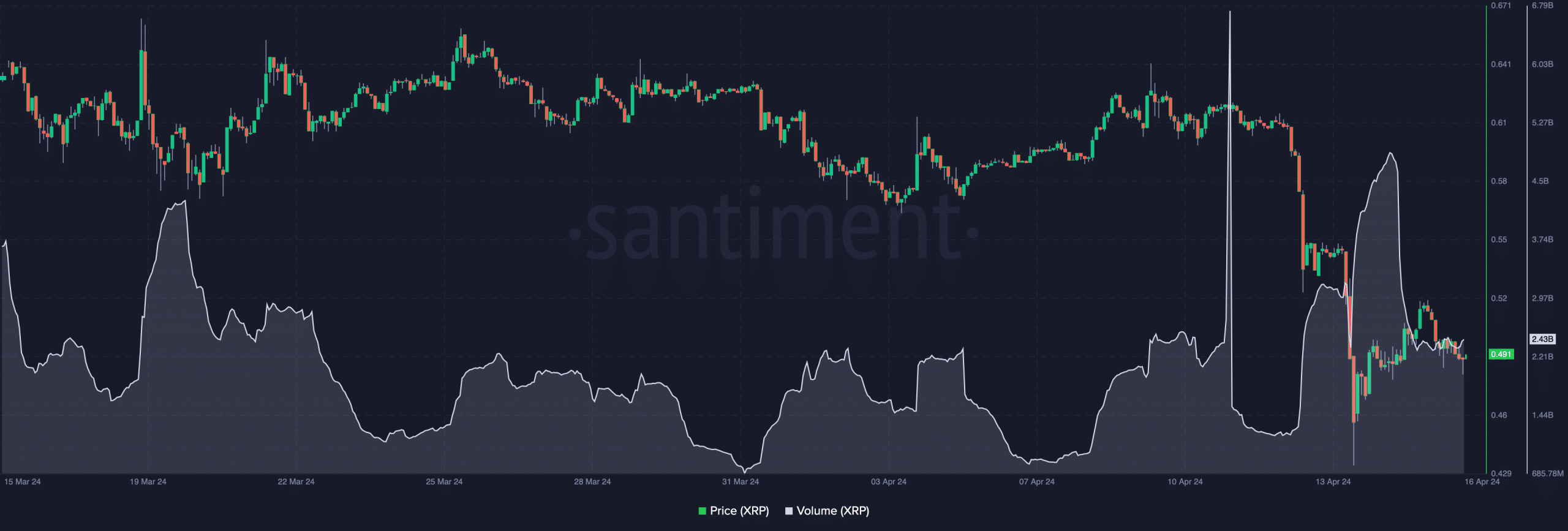

The trading volume of XRP halved within two days, according to data from Santiment. On the 14th of April, XRP’s volume was $4.87 billion. But as of this writing, the metric had plunged to $2.43 billion.

Volume is an indicator of interest in the market. When it increases, it means there is a lot of exchange going on. However, the significant decrease in the token’s volume implied that interest in it has incredibly dropped.

Not only did that happen but its price action also went in the same direction. As of this writing, XRP’s price was $0.49. Two days ago, the same token traded around $0.54, with the recent decline suggesting massive sell pressure.

Is the rescue team coming?

However, XRP might see further downside if the market condition stays bearish. The declining volume and price action was typically supposed to weaken the downtrend.

But if Bitcoin’s [BTC] price continues to slide, altcoins like XRP might find it difficult to rebound. In the meantime, other parts of the Ripple token dropped besides the price, and the notable one was its market cap.

A few months ago, XRP was the 5th most valuable cryptocurrency in the market. However, that was no longer the case as the project was 7th on the standings at press time.

Market cap is a product of price and circulating supply. Therefore, one would admit that its underwhelming price action was responsible for the drop.

AMBCrypto checked the difference between XRP’s market cap and USDC’s and noticed a huge $5 billion difference. With this disparity, it could be difficult for the token to reclaim the 6th spot.

Others eye XRP’s spot

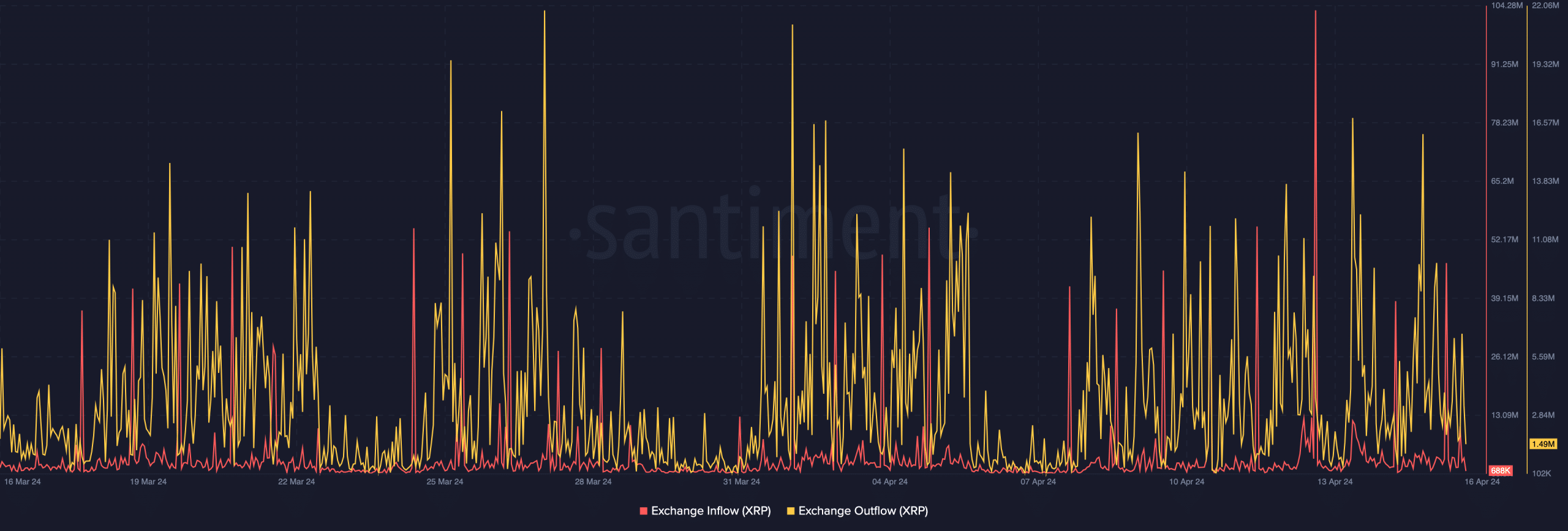

Regarding the short-term price prediction, we looked at the exchange flow. According to on-chain data, XRP’s exchange outflow was 1.49 million. The exchange inflow, on the other hand, was 688,000.

The gigantic difference in the inflow and outflow looks like a great deal for the token’s value. This was because the high outflow implied that fewer participants were willing to sell their tokens.

As a result, XRP could stabilize or trade sideways. But a decline below $0.45 might be unlikely. Instead, the price of the token could move between $0.49 and $0.52 in the short term.

Meanwhile, the long-term might be a little gloomy for the cryptocurrency. Apart from its unimpressive price performance, XRP might be threatened by other coins like Dogecoin [DOGE] and Toncoin [TON].

Is your portfolio green? Check the XRP Profit Calculator

When comparing the performance, we observed that DOGE and TON displayed a better momentum than XRP. Therefore, these two could flip the token. Should this be the situation, XRP might have Cardano [ADA] to contend with for the 10th spot per market cap.

Source link

Recent Comments